Employment

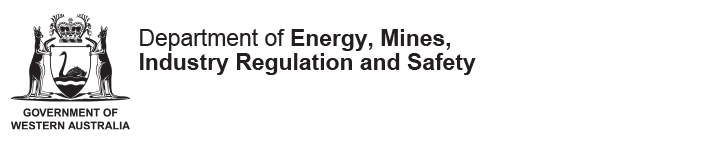

Western Australia’s (WA’s) mining industry achieved another record level of employment with 134,871 full-time-equivalents (FTEs) in 2023-24, reflecting strong levels of mining and construction activity in the State.

This is the seventh consecutive calendar year of growth, the last five of which have been record highs.

The rate of growth in employment, however, did slow to 5.8 per cent, down from

7.1 per cent in 2022-23.

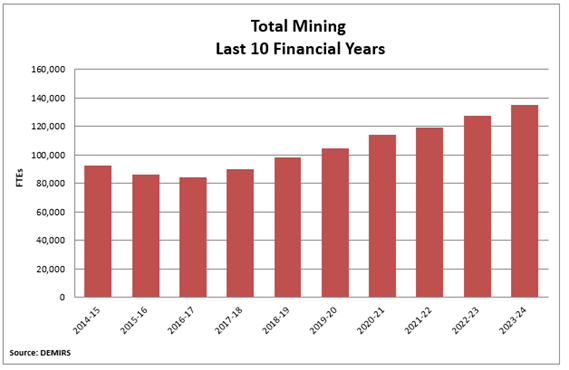

The major contributors to onsite mining employment continued to be the iron ore (62,950 FTEs), gold (31,884 FTEs), lithium (11,386 FTEs), nickel (10,434 FTEs), and alumina and bauxite (7,021 FTEs), industries.

FTEs on mining operations was up year-on-year for most minerals with the major movers being lithium (up by more than 3,000 FTEs), gold (up by more than 1,800 FTEs), and iron ore (up by more than 1,700 FTEs).

FTEs decreased for:

Copper-lead-zinc by almost 500 FTEs as the DeGrussa project wound down and ceased production and sales (in May 2023) and the Jaguar mine was put onto care and maintenance (in September 2023).

Alumina and bauxite by almost 200 FTEs as production was curtailed from Alcoa’s Kwinana alumina refinery.

Employment on mineral exploration sites was 4,163 FTEs, the second consecutive fall from a record level of almost 4,700 FTEs in 2021-22.

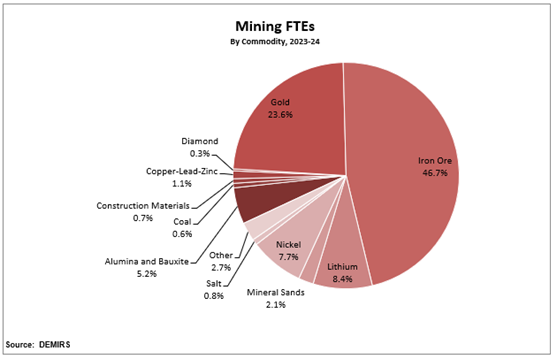

Employment in the petroleum sector dropped to 8,010 people in 2023-24, its lowest level since 2011-12.

This is likely being driven by shorter-term market dynamics including weaker prices, as well as a longer-term decline in new oil and gas developments in the State.

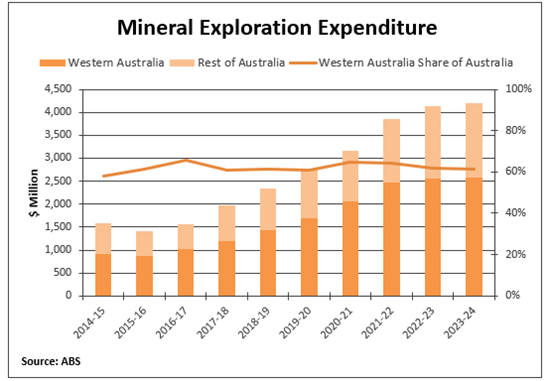

Exploration

WA’s mineral exploration expenditure was $2.58 billion in 2023-24, an increase from 2022-23 but down on the record $2.6 billion spend in 2023.

This result reflects, in part, ongoing efforts to discover new minerals, as well as the impact of rising costs, particularly for labour, equipment and fuel, within the exploration sector.

When combined with a reduction in the number of metres drilled and exploration employment (both indicators of activity), it may well suggest that the level of exploration activity in WA has peaked during the current commodity cycle.

Gold, iron ore, and other minerals (including lithium and rare earths), plus nickel/cobalt and copper, were the main target of spending:

- Exploration expenditure for gold was $884 million, though its lowest level since 2019-20.

- Iron ore exploration expenditure increased marginally to $674 million, its highest level in more than a decade.

- Other minerals (including lithium and rare earths) exploration expenditure was at another record of $575 million driven by forecasts of global demand for electric vehicles and other battery technologies.

- The amount of exploration undertaken for these other minerals is also disproportionately higher in WA compared to the rest of Australia.

- Exploration expenditure for nickel and cobalt was $236 million, down from its

- 15-year highs in recent years likely due to challenging market conditions.

- Copper exploration expenditure was $162 million, down from its peak of more than $250 million in 2021 and 2021-22.

Spending continued to be largely focused on brownfields areas or existing deposits with these areas attracting the highest spend on record of $1.84 billion in 2023-24. In comparison, spending in greenfield locations decreased to $731 million. As a result, the share of expenditure on new deposits fell to 26 per cent.

This may well reflect that brownfields exploration is lower cost and lower risk than greenfields exploration, which means it is likely to be favoured in the current higher cost environment. There has also been recent renewed interest in exploration for commodities on mature ground which had not previously been targeted such as lithium and rare earths.

WA remained the leading destination for exploration investment in Australia. It accounted for 62 per cent of the national spend in 2023-24, which is around its long-term average.

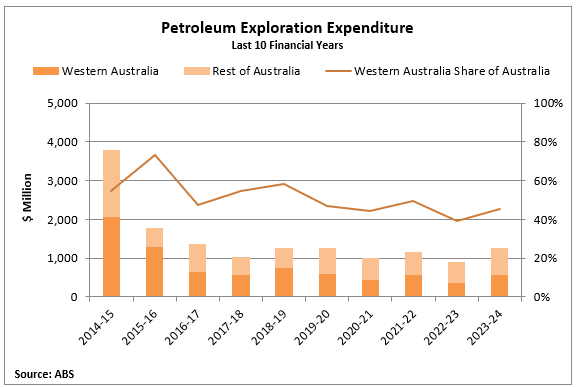

Petroleum exploration expenditure in WA continued its recovery from some of its lowest levels in a quarter of a century to be valued at $569 million in 2023-24 – its highest level in five years.

This upswing was likely largely due to a drilling program by INPEX Corporation in the Browse Basin related to the Ichthys project, as well as campaigns in the Perth Basin.

WA’s share of national petroleum exploration expenditure was 45 per cent, up from its lowest ever level in 2022-23 but still well below its peak of 15-years ago.

This was on account of petroleum exploration expenditure in WA increasing by more than the rest of Australia due to a reduced spend in the Northern Territory.

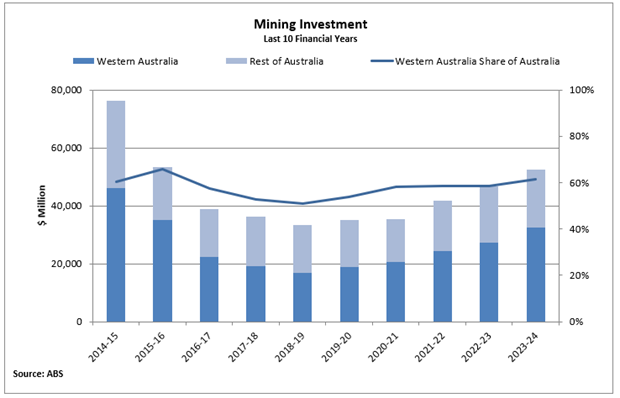

Investment

More than $32 billion was invested in WA’s mining and petroleum industries throughout 2023-24.

This result continues the overall upwards trend in investment since mid-2019.

This result was supported by ongoing construction on major LNG projects including Woodside Energy’s Scarborough project and Shell’s Crux project, as well as major iron ore developments including Onslow (now in the production phase) and Western Range. The increase also likely reflects cost pressures with mining construction projects reporting higher capital costs in recent years.

The level of spending was, however, still only roughly two-thirds of the investment during the peak of the mining investment boom a decade ago.

WA’s share of national mining and petroleum investment increased from recent years to 62 per cent, reflecting a higher rate of growth in spending in WA compared to the rest of the country.

The share was greater than the 10-year average, but below previous highs of

60 to 70 per cent during the tail-end of the mining investment boom.

The resources sector was again the major contributor (72 per cent) to total new capital expenditure in WA, though its share remained below the peak of greater than 80 per cent during the mining investment boom.

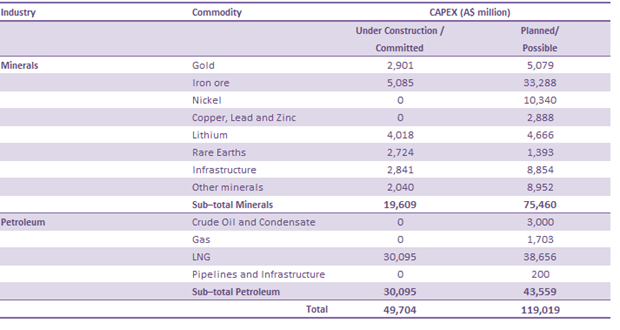

The Department of Energy, Mines, Industry Regulation and Safety also monitors and collects information on mineral, petroleum and associated infrastructure projects in the investment pipeline, and estimates the capital costs of these projects.

Analysis of this information shows that as of September 2024 there were $50 billion in projects committed and under construction, down from the $55 billion in projects in March 2024.

This change was due to the completion of construction and start of production on several significant projects:

- Mineral Resources’ Onslow iron ore project achieved first ore on ship in May 2024.

- Liontown Resources’ Kathleen Valley lithium project produced first spodumene concentrate in July 2024 with an inaugural shipment following in September 2024.

- Pilbara Minerals’ Pilgangoora 680 lithium expansion project was officially opened in August 2024.

Some other significant projects were suspended and put onto care and maintenance, including:

- BHP announced that its West Musgrave copper-nickel project would transition to care and maintenance from July 2024 and be suspended in October 2024.

- Albemarle Corporation announced in July 2024 that it would stop construction activities on Train 3 at the Kemerton lithium hydroxide plant, after previously stopping construction activities on Train 4.

These losses were only partially offset by significant upward revisions in the capital cost of Woodside Energy’s Scarborough project as well as Mitsui & Co and Beach Energy’s Waitsia Stage 2 expansion, as well as a positive Final Investment Decision on Atlas Iron’s McPhee Creek project and Rio Tinto’s Desalination Plant to support its coastal operations.

The estimated capital cost of medium to longer-term possible and planned projects (i.e. undergoing scoping, pre-feasibility and definitive feasibility study) was $119 billion as of September 2024, down by around $800 million from March 2024.

The most notable new medium to longer-term projects announced were Legacy Iron Ore’s Mt Bevan iron ore project and Pilbara Minerals’ Pilgangoora 2000 lithium expansion project, while a new capital cost estimate was provided for Mineral Resources’ Lockyer Deep gas project.

Some medium to longer-term projects will not be proceeding including the Murchison Technology Metals project, following Technology Metals Australia’s merger with Australian Vanadium. Also, the Kunpupintil Lake potash project will not be proceeding after the project tenements were surrendered by Reward Minerals.

For an overview of how Western Australia’s major commodities performed, please see major commodities review 2023-24.

Principal resource projects

Western Australia (WA)’s mining industry consisted of 138 predominantly higher value and export-oriented mining projects in 2023-24, up from 134 in 2022-23 and the highest number since DEMIRS began tracking projects on this basis in 2014-15.

Gold

The number of gold projects fell to 49 in 2023-24, down from 52 during 2022-23, and the gold industry once again had a high degree of turnover and activity:

- There were several new and re-started gold projects during the year, that notably included:

- Auric Mining’s Jeffrey’s Find

- Bellevue Gold’s Bellevue

- Ramelius Resources’ Symes

- However, they were more than offset by gold projects from 2022-23 that either were under the threshold (i.e. they did not produce more than 2,500 ounces of gold), had completed mining, been wound down, or entered care and maintenance. They most notably included Genesis Minerals’ Mt Morgans, Novo Resources’ Beatons Creek, Pantoro’s Halls Creek, Ramelius Resources’ Vivien, and Spartan Resources’ Dalgaranga.

- Westgold Resources’ Beta Hunt project was reclassified as a nickel project for 2023-24 after being primarily a gold project in 2022-23.

Several gold projects also changed hands in 2023-24, including:

- Telfer was acquired by Newmont Corporation through its acquisition of Newcrest Mining in November 2023.

- Beta Hunt and Higginsville were acquired by Westgold Resources after it merged with previous owner Karora Resources in August 2024.

- Deflector and Mt Monger (previously owned by Silver Lake Resources), as well as Darlot and King of the Hills (previously owned by Red 5) became part of Vault Minerals, a newly formed company arising from the merger of Silver Lake and Red 5 in September 2024.

Iron ore

The number of iron ore projects increased from 33 to 36 most notably on Fortescue’s Iron Bridge completing its first shipment in September 2023, and Mineral Resources’ Onslow achieving its first ore on ship in May 2024. Smaller iron ore operations including Kimberley Metals Group’s Ridges, Extension Hill’s Mount Gibson, Hedland Mining’s Poondano, and Twin Peaks (owner 10M subsequently entered administration in June 2024), restarted, while Newcam Minerals also achieved first production at Mt Gould. Some iron ore projects were reclassified with BHP’s South Flank project now considered a principal project after previously being part of the Mining Area C project, while Solomon is now included under Fortescue’s Western project and Mineral Resources’ Koolyanobbing and Parker Range fall under its Yilgarn project, which was due to transition to care and maintenance in early 2025.

Nickel

The nickel industry endured a difficult financial year. While the number of nickel projects increased from nine to 11, due to a single quarter of sales from IGO’s Cosmos project and the reclassification of the Beta Hunt project, several projects were put into care and maintenance amid weak market conditions. These included BHP’s Nickel West operations, First Quantum Minerals’ Ravensthorpe, Mincor Resources’ Kambalda, Panoramic Resources’ Savannah, and IGO’s Cosmos. IGO’s Forrestania project also reached the end of its current economic life.

Lithium

The number of lithium projects increased from six to seven due to the opening of Covalent Lithium’s Mt Holland project in March 2024. However, amid lower for longer prices, several projects were put into or are transitioning to care and maintenance after the end of the 2023-24 financial year. Mineral Resources put Bald Hill into care and maintenance in early December 2024 while Arcadium Lithium is transitioning the Mt Cattlin project into care and maintenance by mid-2025. The Ngungaju plant, part of the Pilgangoora operations, was also to be placed into care and maintenance from December 2024.

Other minerals

There was an increase in the number of mineral sands projects from 10 to 11 with the commencement of production at Kimberley Mineral Sands’ Thunderbird project in October 2023.

The classification of Global Advanced Metals’ Wodgina tantalite project as a principal project brought the number of tantalum projects up from one to two. Wodgina tantalite has been operating on and off since 2010, but its sales values surpassed $5 million for the first time.

While there was no change in the number of manganese projects, mining was suspended at Element 25’s Butcherbird project in late 2023, with stockpile processing operations concluding in the March quarter 2024.

The State’s single producing potash project, Beyondie, was suspended after its owner Kalium Lakes, entered administration in August 2023 and ultimately liquidation.

There was no change to the number of bauxite, coal, copper-lead-zinc, rare earths, salt, silica sands, and talc projects. However, there were some notable events for copper-lead-zinc projects with Aeris Resources’ Jaguar suspended in September 2023 and Sandfire Resources’ DeGrussa project reaching its end of life with final sales of stockpiles in the September quarter 2024.

Basic raw materials

The State's mining industry also comprised hundreds of quarries and small mines in 2023-24 that largely produced the basic raw materials required for the local construction and agricultural industries. Such materials included clays, construction materials (aggregate, gravel, rock and sand), dimension stone, gypsum, limestone, limesand and spongolite. There were 12 principal producers of these materials.

Mineral processing

In 2023-24, there were 16 major mineral processing operations that transformed bauxite into alumina, gold doré into gold bars, nickel ore into nickel concentrate (through toll treatment) and nickel concentrate into nickel matte, nickel powder, nickel briquettes, and nickel sulphate; rutile and synthetic rutile into titanium dioxide pigment; zircon into fused zirconia; silica sand into silicon metal; spodumene concentrate into lithium hydroxide; and rare earth concentrate into rare earth carbonate.

This was one higher than the 15 in 2022-23, with Lynas Rare Earths’ Kalgoorlie cracking and leaching plant commencing the production of mixed rare earth carbonate during the June quarter 2024. However, there were some notable developments at mineral processing projects during the year with the curtailment of production at Alcoa’s Kwinana alumina refinery in June 2024, and the suspension of BHP’s Nickel West operations, which include the Kalgoorlie nickel smelter, Kambalda nickel concentrator, and Kwinana nickel refinery from October 2024.

Petroleum

WA’s petroleum industry consisted of 20 projects that produced oil, gas and condensates from 50 fields in onshore and offshore areas of the State in 2023-24. Many of these petroleum projects had associated processing plants for LNG exports and domestic gas sales.

The number of projects was one higher than in 2022-23 with the addition of Strike Energy’s Walyering onshore domestic gas project, which achieved first gas production in September 2023.

However, notably, Cliff Head had its final oil sales in August 2024.

For an overview of how Western Australia’s major commodities performed, please see major commodities review 2023.